Advocacy

Is the Social Finance Fund the inclusive solution?

Sep 28th, 2023

The recently announced Social Finance Fund (SFF) is intended to meet a critical gap in access to finance for social purpose organizations.

“The SFF will support charities, non-profits, social enterprises, co-operatives, and other social purpose organizations (SPOs) in accessing flexible financing opportunities. Greater access to social finance through the SFF will help them grow, innovate, and enhance their social and environmental impacts.”

This is a much needed, major public policy and program breakthrough. That said, we echo others in the sector, such as Social Economy Through Social Inclusion (SETSI), who are concerned with the initial design and rollout. There is a lack of equity and diversity in its structure, its potential ability to truly reach the intended communities, and to achieve the intended impact outcomes from the loans.

Another concern raised is why diversity and inclusion have been highlighted as critical gaps in the way the fund is structured and implemented? Why do we need this fund when there are already several federally funded business development programs that have large budgets, have been operating for years and have the mandate to provide business supports and financing opportunities for small and medium sized business development and growth?

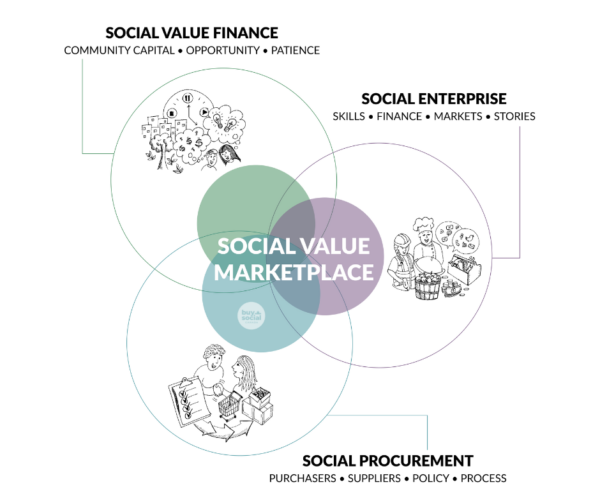

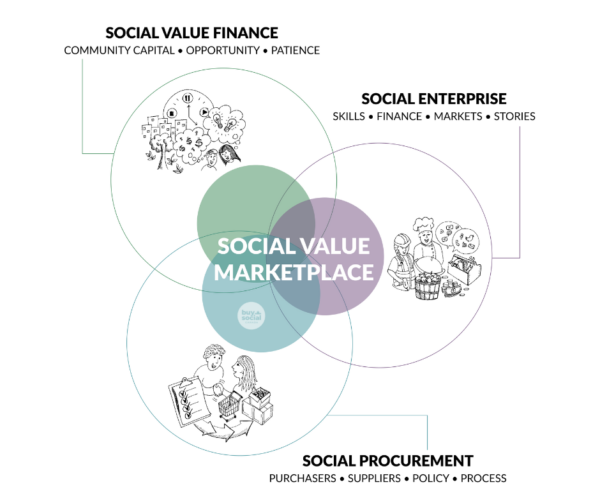

The social value marketplace is as good as the sum of its parts: social procurement, social finance, and social enterprise. A few years ago, at the Buy Social Canada Symposium “Social Procurement Today and Tomorrow” Eduardo Gomez, then Manager of Procurement Transformation at the City of Calgary shared that his “dream is that we level the playing field to a point that all procurement is social procurement.”

We’re certainly not there yet but over the last 5 years we have seen a groundswell of momentum in implementing social procurement. In order for social enterprises and social purpose organizations to respond to that demand they need access to finance and business supports.

Social Finance Today

So what is needed from social finance and business development supports to get social enterprises and social purposes organizations on a level playing field?

Recent research conducted by Buy Social Canada surveyed 132 Buy Social Canada Certified social enterprises to show the top three challenges social enterprises face.

- Access to markets (59%)

- Business capacity (51%)

- Access to finance (48%)

There is demand for access to finance that is accessible and inclusive and the SFF is an opportunity to responsively close the gap.

So if social finance is needed now, is the Social Finance Fund hitting the mark?

The Social Finance Fund isn’t shifting the power, decision-making or access to capital to communities and businesses that have been marginalized. It is still finance for financiers, not community.

Social Finance Tomorrow

The Social Finance Fund is one piece of the puzzle, a relatively small and time limited program of support. But more importantly, many mainstream federally funded business development programs and funds are not accessible to social enterprises.

- Business Development Bank, BDC, says they “provide management services such as counselling, training and planning” and make loans to small businesses. They have been operating for almost 80 years, with a 1975 adjusted mandate to become “one-stop shop” for small businesses.

- Community Futures Program, CFP, which “was formally established in 1985 and plays a key role in business development in rural and remote communities across Canada.”

- Futurpreneur Canada, “formerly Canadian Youth Business Foundation (CYBF), is a national, not-for-profit corporation created in 1995 that provides financing, mentoring, and support tools to young Canadian entrepreneurs between the ages of 18 and 39.”

Around 2010 David LePage, funded by ESDC, looked at the issue of social enterprise access to small- and medium-sized enterprise (SME) programs. The findings indicated that across 100 government services businesses, only a small percentage could not serve non-profits or co-ops because of their legislative or regulatory restrictions. While the majority could serve social purpose organizations, in practice they did not. While comprehensive research hasn’t been recently repeated, anecdotal evidence suggests that very little has changed.

If even 20% of the BDC assets were targeted to social purpose organizations that would make around $8 billion worth of funding available. Imagine the impact on rural social purpose organizations if Community Futures made community social and environmental impact a measurable and reportable requirement and investment outcome of 50% of their funds. How many start-up social enterprises and co- operatives could emerge well prepared and investment ready if nurtured by Futurpreneur advisory services and funding?

Today we are right to celebrate the launch of the Social Finance Fund, while remaining diligent and advocating for a fund that includes and recognizes the expertise of community, and particularly marginalized groups, in the design and implementation.

However, the Social Finance Fund is a time and dollar limited amount lasting at maximum the next 10 years. The other funds, like BDC (80 years), Community Futures (40 years), and Futurpreneur (28 years) are much more secure and entrenched budget fixtures.

How do we ensure that in 10 years time we can say we have created an impactful social finance ecosystem?

- We use the Social Finance Fund as a limited time demonstration and innovation project. We dramatically expand its innovation, inclusion and equity outcome directives. We expand the type of finance intermediaries that are engaged. Then, as we’re learning and building tools through Social Finance Fund, we can inform and influence Step 2.

- Beginning in fiscal year 2024 we require all Federally funded programs that support the development, advisory services, loans, or investments to small or medium sized businesses to include, target, and report on their outcomes in supporting the development and financing of “charities, non-profits, social enterprises, co-operatives, and other social purpose organizations (SPOs).”

What’s our vision for tomorrow?

“It is time to go beyond the trading dogma and business practices of extraction economics that result in social exclusion and income inequality. It is time for a social value marketplace revolution that generates the community capital needed to build healthy communities.” – Marketplace Revolution, David LePage

If you’d like to support this vision:

- Write a letter like this one to your MP to advocate for the inclusion of social enterprises in federally funded business supports

- Subscribe to the Buy Social Canada newsletter to stay up to date on social enterprise and social procurement news and events

- Contact us if you have any questions at info@buysocialcanada.com